On February 18, when Shri Narendra

Damodardas Modi becomes India’s second ever Prime Minister to inaugurate the

Aero India expo (the first was Shri H D Deve Gowda), he, accompanied by Defence

Minister Shri Manohar Parrikar and Minister of State for Defence Shri Rao

Inderjit Singh, can be expected to view both the aerobatic demonstrations by

both home-grown and foreign platforms as well as visit those exhibition halls housing

the exhibits of India’s Defence Public Sector Undertakings (DPSU) as well as

those of the Defence Research & Development Organisation (DRDO). It remains

to be seen if the expo organiser—the Ministry of Defence’s (MoD) Defence

Exhibition Organisation (DEO)—will take the assembled VVIPs to view the

exhibits of the Indian Space Research Organisation (ISRO). In case the VVIPs do

make it there, this by itself will constitute a grim reality check. Why so?

Because traditionally, the booth—itself left segregated in an insignificant

corner inside a makeshift exhibition hall—is largely left unmanned. Anyone

familiar with ISRO’s exploits and achievements will indeed find this hard to

believe or digest, but this has been a fact of life for far too long! One

therefore can only hope that NaMo takes stock of this and demands urgent

remedial measures from the DEO.

Let’s now venture into the expo proper:

although it has been hailed as an aerospace expo, Aero India has traditionally

been strictly for military aviation. Why? Simply because the DEO has no idea about

what exactly constitutes the aerospace industries and markets. Consequently, no

one from the DEO bothers to canvass abroad for participation by the space

agencies and OEMs from countries like the US, France and Russia. Similarly, you

won’t find any reputable foreign MRO service provider, nor any original equipment

manufacturer (OEM) producing commercial aircraft interiors, galley equipment, avionics,

in-flight entertainment systems, etc. etc. Likewise, if anyone thinks that the

expo will play host to OEMs for airport ground support hardware or aerobridges,

he/she will definitely draw a blank. Of the 328 OEMs from 33 countries

participating in Aero India 2015, the US will have the largest representation

with 64 companies, followed by France with 58 companies, the UK with 48, Russia

with 41 and Israel with 25. Although the total number of foreign companies

participating has risen sharply from 212 in Aero India 2013 to 328 this year,

rest assured that 99% of them will be hawking their products for off-the-shelf

purchases.

Participation by Indian exhibitors,

which has risen from 156 companies in 2013 to 266 this year, will be accounted

for mostly by the DPSUs and DRDO laboratories, with only a tiny sprinkling of

MSMEs. For the very first time there will be participation from three states—Karnataka,

Gujarat and Andhra Pradesh—that wish to attract foreign OEMs setting up shop in

their territories.

Suggested

Reality Checks

Here are a few questions that NaMo and

Shri Parrikar ought to ask their Mod-owned DPSU hosts if and when they visit

their respective pavilions:

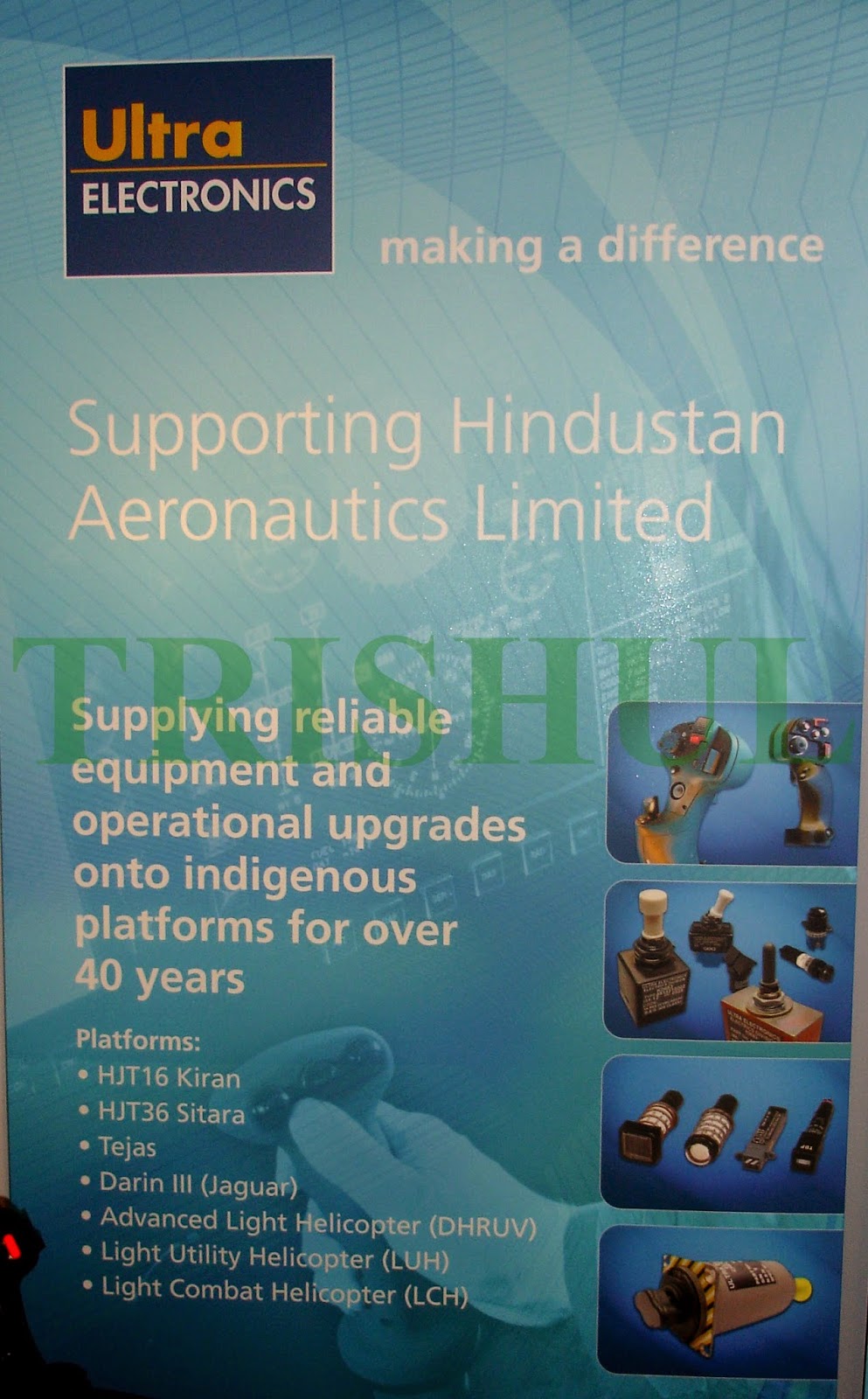

Why has the Hindustan Aeronautics Ltd (HAL)

consistently shied for a full decade now away from obtaining EASA airworthiness

certification for the Dhruv ALH?

Why has the Indian Army’s Aviation Corps

not yet raised its first squadron of the ‘Rudra’ helicopter-gunship despite taking

delivery of the first such helicopter back in February 2013?

What is the Dhruv ALH’s percentage of

claimed indigenisation by weight, by volume, by cost, and by technological

content? This is because imported equipment may constitute only 20% of the

platform by weight and volume, but could account for as much as 80% of the cost

and technology content.

Similarly, what will be the claimed

indigenisation by weight, by volume, by cost, and by technological content of

the HAL -developed Light Utility Helicopter’s (LUH) and Light Combat Helicopter’s

(LCH)?

Which entity—HAL or the DRDO’s

Aeronautical development Agency (ADA)—should be primarily responsible for commercially

marketing the Tejas family of multi-role combat aircraft (MRCA)? And this is

why I’m asking this question: If a certain customer, let’s say Egypt, is

interested in procuring the Tejas Mk1 MRCA’s tandem-seater version configured

as a lead-in-fighter trainer (LIFT), but it wants to procure the aircraft with non-Israeli

multi-mode pulse-Doppler radars, helmet-mounted displays and laser designation

pods, which entity should be held accountable for delivering the customer-specified

end-product: HAL, the aircraft manufacturer, or ADA, the aircraft designer-cum-systems

integrator?

Which OEM supplies all the synthetic

resins that are used for fabricating all the co-cured composite airframe

structures for the Dhruv ALH, LCH, LUH and the Tejas MRCA? Is the OEM a ‘desi’

one?

Why does India still need to import

Ni-Cd batteries for the Tejas MRCA, Dhruv/Rudra ALH, HJT-36, Mi-25 and Mi-35P

platforms, as well as for the Searcher Mk2 and Heron UAVs?

Why has no one in India ever thought

about devising indigenous alternatives to imported weapons ejector racks/pylons

for platforms like the Dhruv/Rudra ALH and Tejas MRCA?

Why has the DRDO failed to develop chaff

countermeasures kits for both fixed-wing and rotary-winged manned military

platforms?

If the hybrid RLG/GPS-based inertial

navigation system developed by the DRDO’s RCI laboratory has been successfully

flight-tested numerous times on board different types of ballistic and cruise missiles, then

what prevents it from being used on-board platforms like the Tejas MRCA and

LCH?

When will the fully functional

DRDO-developed Rustom-1 MALE-UAV begin entering service? Why has the DRDO

failed to adhere to the original service-entry deadline of late 2013?

Why has the DRDO failed so far to

develop COMINT and ELINT payloads for both the Rustom-1 and Rustom-2 MALE-UAVs?

Why does the DRDO-developed Ku-band

synthetic aperture radar (SAR) occupy twice as much space volume as that of the

in-service EL/M-2055D SARs delivered by the ELTA Systems subsidiary of Israel

Aerospace Industries?

Does the DRDO possess any technological

roadmap for developing a family of airborne AESA-MMRs? Or has it restricted

itself to developing only the ‘Uttam’ AESA-MMR for the projected Tejas Mk2/LCA

(Navy) Mk2 MRCA when, worldwide, established OEMs and developers of AESA-MMRs

are busy introducing newer mission-specific applications, such as the EL/M-2022ES

that can go on-board both UAVs and manned maritime surveillance/ASW platforms?

Will the MoD insist on procuring

left-hand-drive TATRA heavy-duty trucks from BEML for mounting the DRDO-developed

and BEL-built S-band Arudhra MPRs and Ashwini MRSRs? Or will the MoD ensure a

level playing-field by soliciting competitive bids from both BEML and India’s

private-sector truck manufacturers?