The

figure of Rs.525 crore or approximately €79 million per Rafale, which the

Indian National Congress has been citing, is based on Dassault Aviation’s 2007

RFP response at the then exchange rate (€I = Rs.66) and that too for only the

18 Rafales that were to be delivered off-the-shelf by Dassault Aviation. The

2007 price for each of the 18 Rafales would have amounted in 2015 to €100.85

million (Rs.765.4 crore at 2015 exchange rate of €1 = Rs 75.90). Similarly, the

2007 bid price for every Eurofighter EF-2000 would in 2015 have worked out to

be €102.85 million, higher than that of the Rafale. In comparison, the average price

of each of the 36 “bare/green” Rafales bought in 2016 is €91.7 million (Rs.696

crore at the 2015 exchange rate), lower than both the earlier 2007 Rafale and

Eurofighter EF-2000 RFP responses. The exact price for the 28 single-seat Rafales is €91.07 million (Rs.681 crore) each; and that of each of the eight

tandem-seat Rafales is €94 million (Rs.703 crore).

Coming to unit-prices of the 108 Rafales

that were to be licence-assembled by the Bengaluru-based and MoD-owned

Hindustan Aeronautics Ltd, or HAL (the workshare agreement between HAL and

Dassault Aviation was signed on March 13, 2014), Dassault Aviation had estimated

that each HAL-built Rafale will cost 2.7 times more (including Rs. 68 crore in

labour costs alone per aircraft) than a Rafale delivered by Dassault Aviation.

This is because not only would HAL have had to upgrade its in-house airframe

fabrication and systems integration capabilities entirely through imported

hardware and expertise, but the same also would have had to be undertaken by

several of the private-sector and public-sector industrial entities that had

been identified by HAL and Dassault Aviation as vendors. These would have

included the following:

Airframe

Component Providers: fuel tanks and pylons (5 vendors), tooling hardware (12 vendors),

mechanical parts and sub-assemblies (21 vendors)

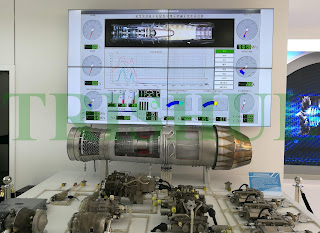

Turbofan

Component Providers: mechanical parts, tubes and pipes (5 vendors)

Avionics

Components Providers: AESA-MMR sub-assemblies,, cockpit displays (3 vendors), electronic

boards (4 vendors), automated test-benches (5 vendors)

Accessories

Providers: cabinets (3 vendors), screws and rivets (1 vendor), tubes (1 vendor),

wiring harnesses (5 vendors)

Simulator

Services Provider: 1 vendor

Ground

Support Equipment Supplier: 6 vendors

Engineering,

Software & Services: 13 vendors

Data

Conversion Service Provider: 2 vendors

MRO

Services Provider: 4 vendors

Customer-Furnished Hardware Specified For Integration With Rafale M-MRCA

All the IAF Rafales will feature 14

customer-specific modifications, comprising: 1) integration of the RAFAEL-supplied LITENING target

acquisition/designation pod; 2) integration

of the RAFAEL-supplied Spice-1000 standoff PGM and its related data-link pod; 3) integration of MBDA-supplied Meteor

BVRAAM and ALARM anti-radiation missile; 4)

integration of the RAFAEL-supplied X-Guard towed-decoy and development of its

on-board location cabinets; 5)

upgradation of the SPECTRA EW suite to accommodate low-band, medium-band and high-band

directional jammer apertures; 6) integration

of the TARGO-2 HMDS supplied by Elbit Systems (also ordered by Qatar); 7) installation of a THALES-supplied

traffic collision avoidance system (TCAS); 8)

installation of a THALES-supplied standby radar altimeter; 9) Optimisation of the M88 turbofan’s jet-fuel starter for

operating in sub-zero temperatures at altitudes above 9,000 feet ASL; 10)

increase in the capacity of the on-board OBOGS; 11) addition of weather-mapping mode of operation in the

THALES-supplied RBE-2 AESA-MMR; 12)

development of quad-pack ejectors for the DRDO-engineered and Spice-250

PGM-derived SAAW EMP-generating standoff PGM; 13) assistance in flight-qualification of DRDO-developed 450kg laser-guided

HSLD bomb and integration of the bomb’s FOG-based inertial navigation system

with the Rafale’s on-board Sigma-95N RLG-INS through a MIL-STD-1553B interface;

14) modification of the Sigma-95N

RLG-INS’ coupled GPS transceiver in order to receive MIL-STD PY-code coordinates

from India’s NAVIC/IRNSS constellation of GPS satellites.

BOTTOMLINE

Nett cost of each of the 18 fully

weaponised Rafale M-MRCA in flyaway condition as negotiated by the UPA-2

government was Rs.1,705 crore and that of each meant-to-be-licence-built Rafale

was Rs.4,603.5 crore, whereas the figure for each of the 36 flyaway Rafales now

on order works out to Rs.1,646 crore.

Contrary to the Indian National Congress’

allegations about the Dassault Reliance Aerospace joint-venture industrial

entity being the sole beneficiary/executor of the 50% indirect industrial

offsets package that forms part of the €7.87

billion (Rs.59,000 crore) Rafale M-MRCA contract, Dassault Reliance Aerospace will

only be one of several key industrial players in the execution of offset obligations.

This is because under any government-to-government contractual agreement, industrial

offset obligations are always fulfilled by respective industrial consortiums,

i.e. from the French side the consortium comprises OEMs like Dassault Aviation,

THALES and the SAFRAN Group. And THALES and the SAFRAN Group are still in the

process of finalising their industrial offsets obligations. Consequently, each

of these three French OEMs is entitled to fulfil only one-third portion of the

mandated 50% industrial offsets content.